Coronavirus impact on Bangladesh Economy

Published on: 19th April 2020

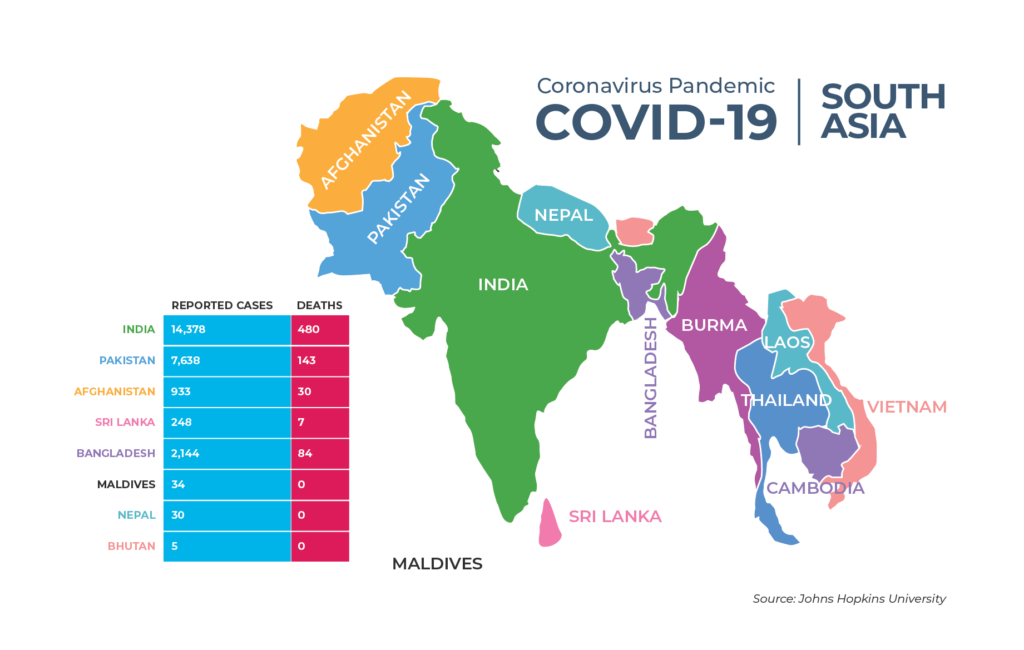

Coronavirus impact: March 8 marks the day when first coronavirus case was announced and within the next few days, first death was confirmed by the authority.

Amid growing concerns of mass infection, the government of Bangladesh since then has taken a number of initiatives and measures to protect its 160 million people.

To prevent fast-spreading of COVID-19 in one of the densely populated countries on earth, the government initiated a partial lockdown from 26th of March which was later extended until 25th of April – a move to restrict movement and ensure social distancing. Since then the number of cases along with fatalities has increased to 91 deaths and 2,456 confirmed cases, at the time of this report.

Figure 1: Number of cases and deaths in Bangladesh

[display_covid_19_data_line_chart country=”Bangladesh”]

In light of the coronavirus pandemic, the government announced health directives and stimulus package worth around 100,000 core ($11.78 billion). The declared amount is 3.3% of total GDP and various social safety net programs to protect the most vulnerable ones.

Low-income people especially informal workers involved in the likes of garments, hospitality and transport sectors will be hit hard. These group of people have limited or no access to already struggling healthcare system.

A mass exodus of migrant workers from capital Dhaka to rural areas has already taken place. Staying without jobs for a long time may force many of them back into poverty. Despite having enough food grain in stock, as declared by the authority, a prolonged lockdown may threaten food security.

Under the assumption of a prolonged lockdown, a major challenge for the government would be preparing its healthcare systems. Also, ensuring access to basic needs such as food, medical supplies and shelters would be crucial.

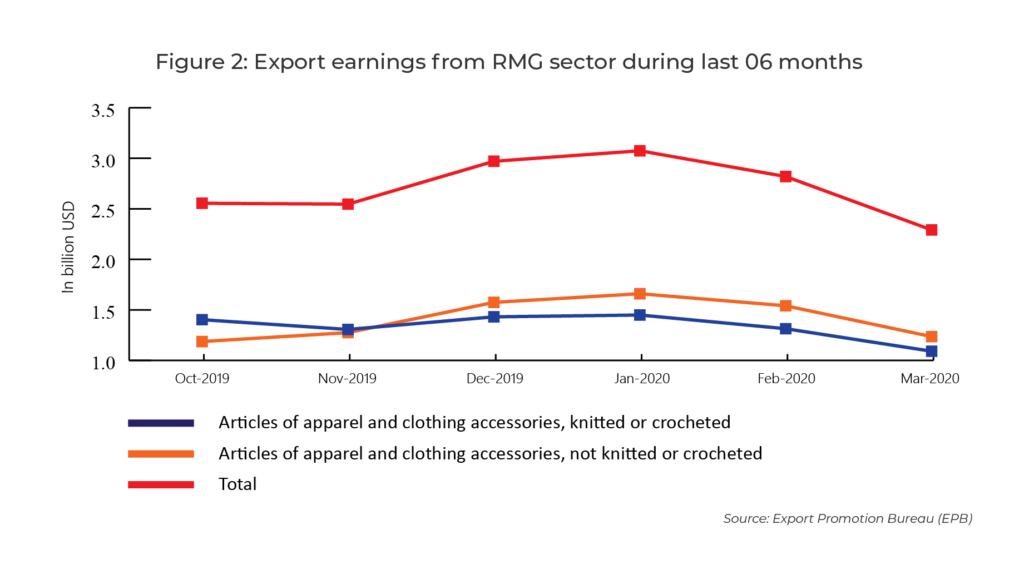

The effects on the garment industry

Bangladesh is the 2nd largest apparel producer after China and its economy is heavily dependent on the exports of this $40 billion industry. This key sector is under serious threat and set to lose around $6 billion of export revenue as hundreds of factories received cancellation of work orders.

According to Rubana Huq, president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), retailers and brands across the world have cancelled orders worth of $3.5 billion by activating force majeure clause.

RMG sector accounts for around 84% of the $40 billion exports while employing 4 million workers. A significant number of them are women and an estimated 20 million people are directly or indirectly dependent on this sector.

In a bid to curb out losses, the government of Bangladesh has already launched a $595 million package for the garments sectors so that struggling factory owners could pay their workers, however, many expressed that it isn’t enough.

The effects on the garment industry

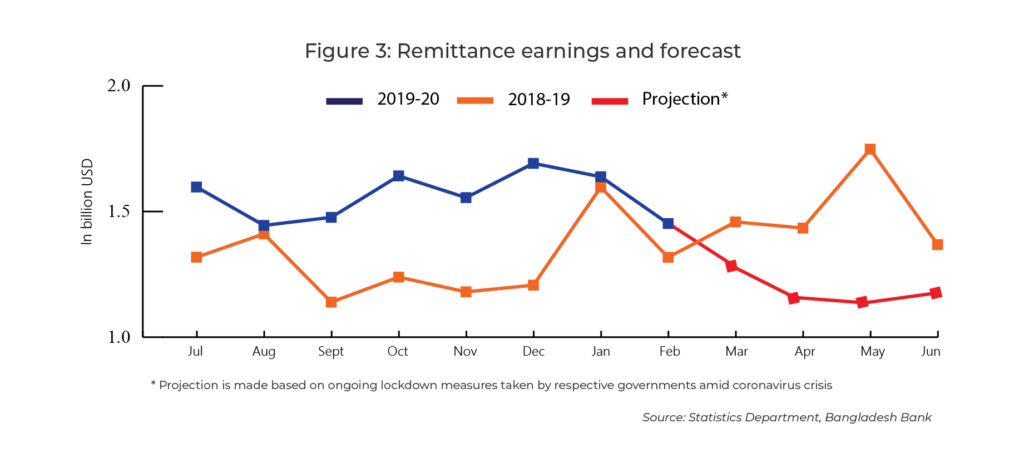

Bangladeshi migrant workers have been one of the major driving forces for economic growth for decades. But experts now fear that a big shock lies ahead amid coronavirus prevalence.

More than 10 million expatriates living across the globe remitted $16.4 billion during 2018-19 fiscal years. However, remittance inflow will fall in the coming days as a large number of workers have already returned home due to lockdown in their hosting countries.

Many of those who returned or remained abroad were furloughed as the crisis deepened. And this will hit foreign exchange reserves while threatening livelihoods of millions – especially rural families.

During 2018-19 fiscal years, more than half (61.71%) of the country’s remittance came from Saudi Arabia ($3.11 billion). The next substantial amount came from UAE ($2.54 billion), the USA ($1.84 billion) Kuwait ($1.46 billion) and the UK ($1.17 billion).

All these countries have taken strict measures to contain the virus. These key labour markets are witnessing economic slowdown which has created a major concern for our wage earners.

The effects on the garment industry

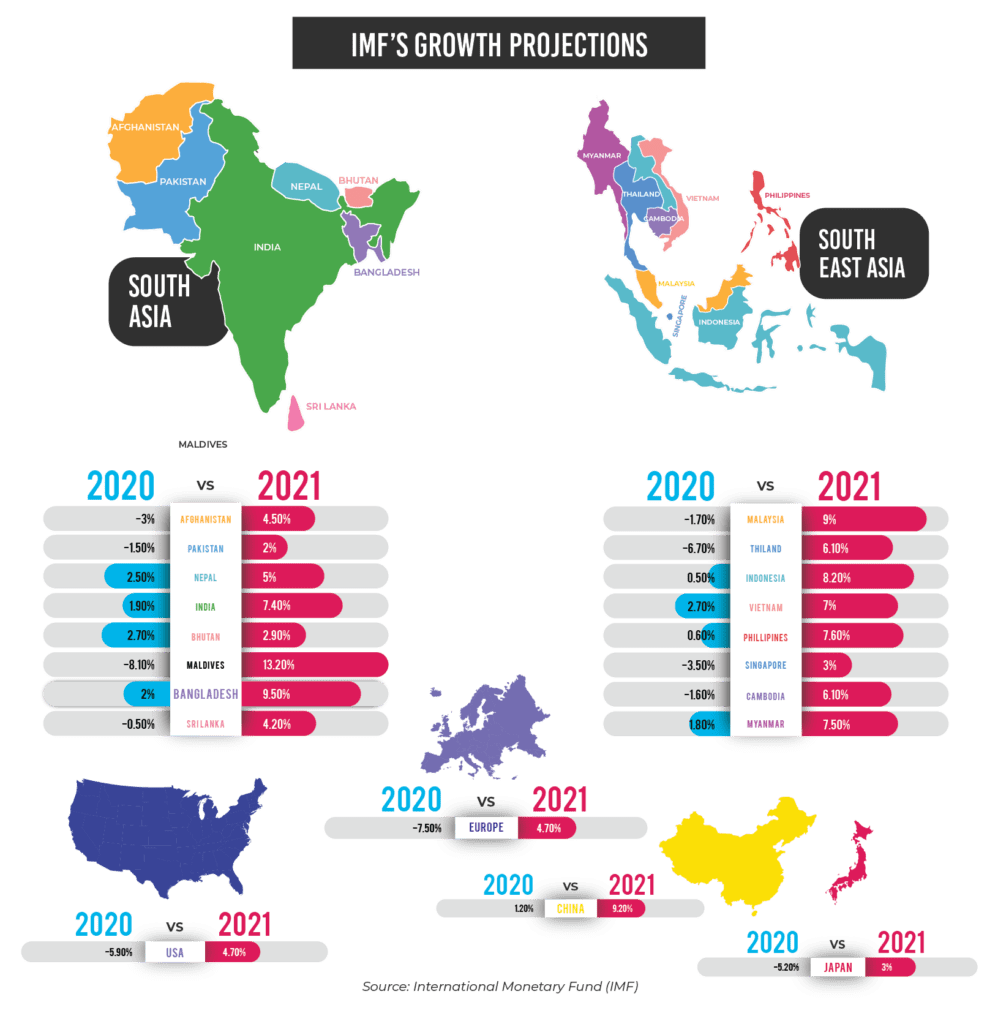

Bangladesh has been achieving more than 7 per cent growth constantly for the last few years. In 2019 the country recorded an 8.15% GDP growth while its per capita income increased to $1,906.

An upward growth trend was predicted previously however due to coronavirus outbreak, Bangladesh’s economy would experience an unprecedented trajectory – as feared by global economic watchdogs.

International Monetary Fund (IMF) projects 2.0 per cent growth this year but predicts a strong rebound in FY2021 achieving 9.5 per cent. This prediction has been welcoming news during this crisis moment as the country battles the pandemic.

Earlier the World Bank predicted between 2% and 3% growth for 2020. The agency forecast a further decline – 1.2 to 2.9 per cent – in 2021 due to COVID-19 outbreak.

Although finance minister Mr Mustafa Kamal strongly disagreed with this forecast. He argued that industrial and service sectors might face negative impact due to uncertain situation. However, the country’s agricultural sector would be relatively less affected which will offset serious economic losses.

IMF in its 2020 World Economic Outlook predicts that the global economy could shrink by 3 per cent during 2020 due to the collapse of economic activity driven by the COVID-19. However, a partial rebound in 2021 is expected with a 5.8% world economic growth. But these projections were made base on ‘’extreme uncertainty’’ and the actual impacts could be far worse.

Gita Gopinath – the IMF’s chief economist – said that under the best-case scenario, the world is likely to lose $9 trillion in inputs over the next two years. The estimated loss is greater than the gross domestic products of advanced countries such as Germany and Japan. Developing economies like Bangladesh will be adversely affected due to the global economic ramifications of the coronavirus outbreak. A potential disruption in the supply chain could leave many without jobs for a long time.

Authors: Sujon Ahamed (Head of Market Research) and Md. Obaid Hossain (Designer) NewVision Solutions Ltd.