Coronavirus Effect on the Bangladesh’s Steel Industry

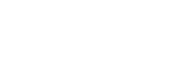

Steel industry of Bangladesh have contributed immensely in the country’s overall infrastructure development by providing long steel products such as rebar, angel, beam and channel. Demand for long steel has increased sharply in recent years – currently 7.5 million MT of rebar which was merely 2.5 million MT in a decade ago. Per capita consumption of steel stands at 45kg which was only 25kg in 2012 – per capita, steel consumption is expected to be 73kg by 2022.

Steel industry of Bangladesh have contributed immensely in the country’s overall infrastructure development by providing long steel products such as rebar, angel, beam and channel. Demand for long steel has increased sharply in recent years – currently 7.5 million MT of rebar which was merely 2.5 million MT in a decade ago. Per capita consumption of steel stands at 45kg which was only 25kg in 2012 – per capita, steel consumption is expected to be 73kg by 2022.

The steel industry is set to lose Tk 4,000 crore as the COVID-19 outbreak has disrupted the production due to factory closures and import of raw materials which are mainly sourced from Russia, India, the USA and Canada.

A prolonged lockdown in these countries could cause serious damage to the supply chain as more than 90% of the raw materials (steel scraps) are still imported. Most of the rolling mills will be forced to shut down due to shortage of raw materials despite having the domestic shipbreaking yards which also provide melting scrap but not enough.

A thriving industry

To fulfil the growing demand, BSRM and AKS – two of the major steel producers – have already installed efficient state-of-art induction and electric arc furnace. Other competitors such as PHP, GPH Ispat and KSRM are also expanding their production capacity to provide different types of steel products which were once imported.

Overview of long steel products – Rebar

Source: NewVision Reseach

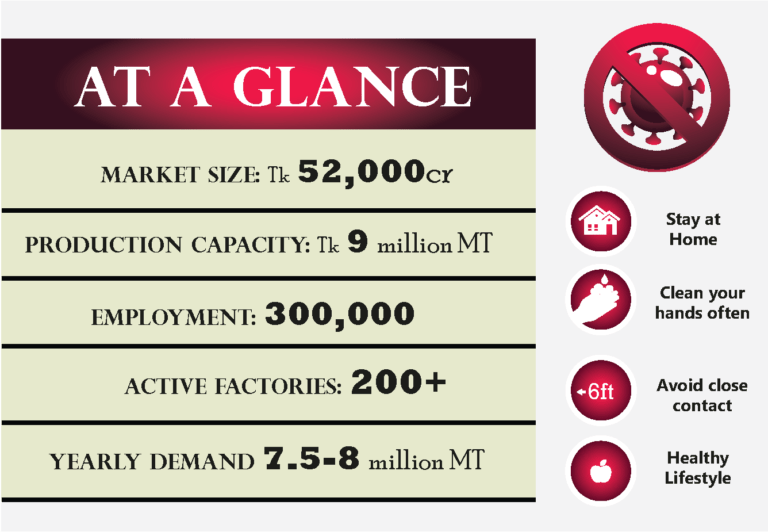

Despite making a significant investment by the major steelmakers, local producers are capable of producing 90% of the total required billets. The country still imports billets as some manufacturers produce billets to serve their own re-rolling mills and a large number of small to medium rolling mills don’t have the billet producing capability.

Imports of billet, on the other hand, have reduced sharply in recent years. During 2013-2014, approximately 1.6 million MT of billet was imported however during the 2018-2019 fiscal year, this number has slumped to only 0.5 million MT.

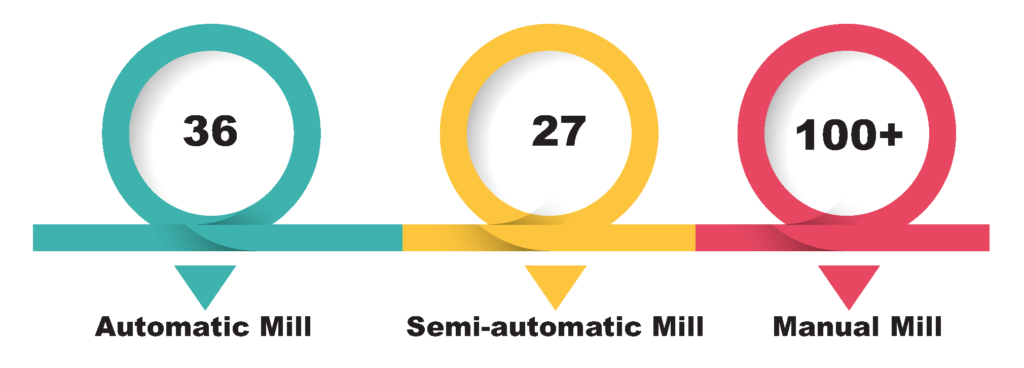

At present, Bangladesh resides more than 300 – although around 100 mills are not in production at the moment – steel mills and a majority of which are manual mills however in recent years number of automatic and semi-automatic mills have increased proportionately.

Growing demand for graded products has forced local manufacturers to upgrade their production facility. In order to stay in the competition, some small mills have created joint-venture companies to shift away from manual to semi-automatic mill.

Type of Steel Re-rolling Mills in Bangladesh

Source: NewVision Reseach

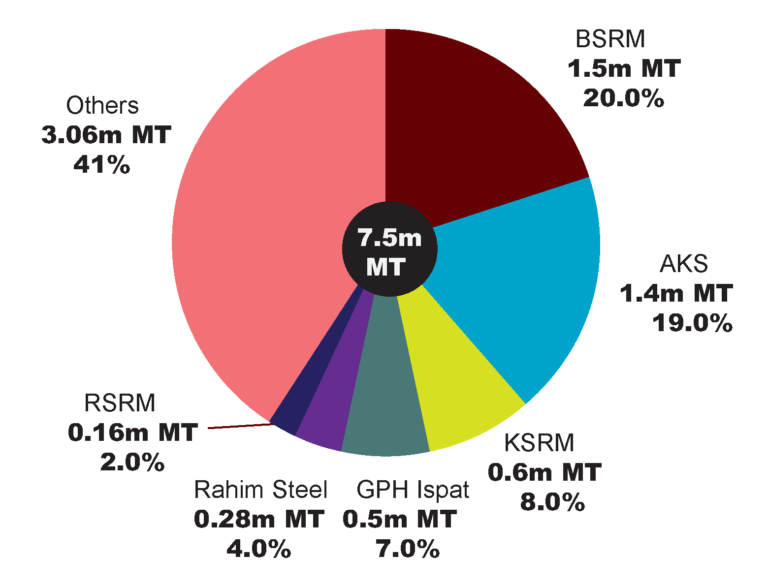

Domestic competiion

Giant steelmaker BRSM and AKS dominate the market providing almost 40% of country’s total demand whereas KSRM and GPH Ispat two other major players have 8% and 7% market share respectively. Market leader BSRM, a public listed company produces 1.5 million MT of rebar per year and privately owned AKS – a concern of Abul Khair Group – who is also the largest manufacturer of the corrugated sheet, produces around 1.38 million yearly.

GPH Ispat, another public listed company, has recently signed an agreement with Primetal Technologies Austria GmBH (a joint venture of Siemens VAI & Mitsubishi Heavy Industries and partners) to set up an integrated steel plant with the state of art and the most sophisticated production facility. Once completed its production capacity of billets will increase to 1 million MT while rebar production would increase to 760,000 MT – currently, 640,000 MT.

Yearly actual production of major players and their market share- Rebar

Source: NewVision Reseach

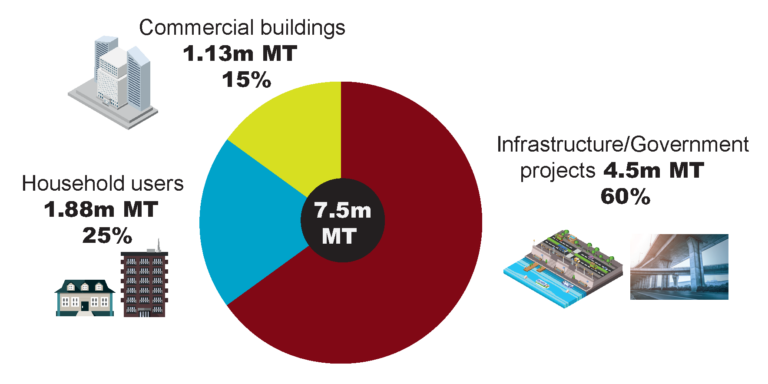

Steel usage in the construction sector

A stark increase in infrastructural projects – for constructing bridges, airports, highway, metro rail, economic zones, Power-plants and so on – has driven up demand for steel significantly in recent years.

Bangladesh steel industry has experienced around 10% to 15% growth per annum leading to total demand of 7.5 million MT in the last fiscal year. The country is also one of the largest importers of Scrap, Sponge and Pig iron – understood to be 2nd largest scrap importer in South East Asia and 4th in as a whole Asia region.

Government is the biggest user of rebar consuming 60% of total demand while household users need another 25% but this number is expected to increase rapidly in the coming years. Industry insiders predict that household users would require approximately 40% of total demand in the future – a shift in which general households would be using more steel.

End users of rebar

Source: NewVision Reseach

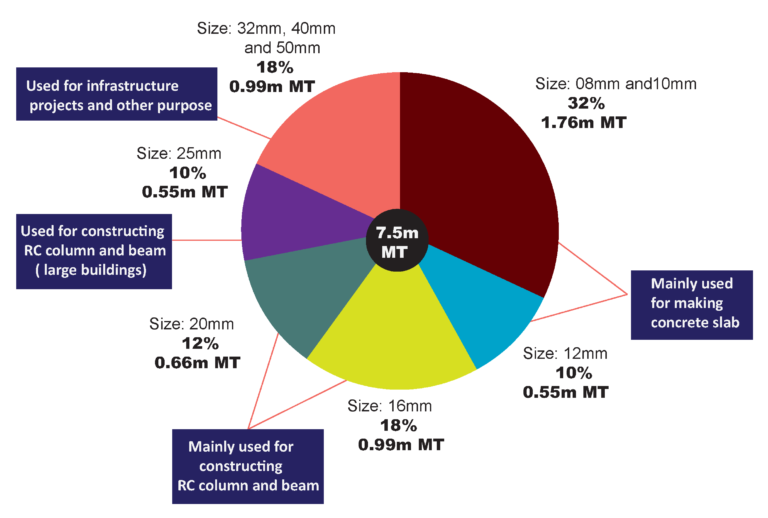

Almost every manufacturer produces 8mm to 40mm rebar and only BSRM can produce 50mm which are mainly used for heavy construction such as bridges, flyover and so on. Local millers usually produce such rebar on the basis of a request from construction companies.

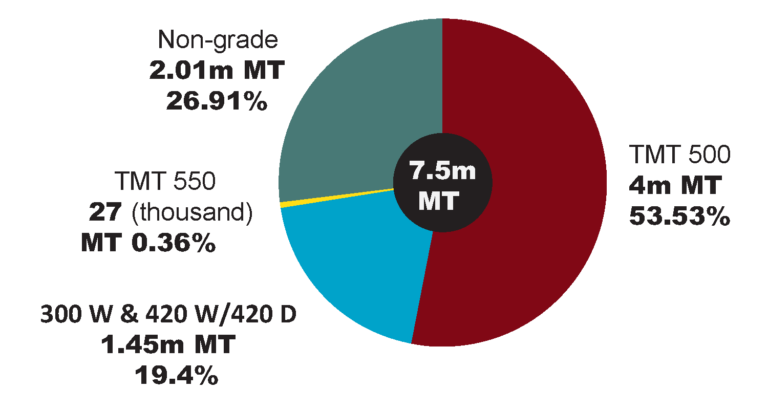

TMT 500 (grade 72.5) is the most popular products in Bangladesh – total demand is 4 million MT per year – and a significant of steel used in the country is non-graded rebar which is expected to decline in the coming years as consumers are becoming more concern about the quality of the rebar they use for the construction.

Grade-wise demand of rebar

Source: NewVision Reseach

Products of 10mm, 12mm and 16mm size have the most demand in Bangladesh accounting for 58% of total rebar used. Other most selling sizes of rebar include 20mm and 25mm which also have sizeable demand especially for constructing high rise commercial buildings and government infrastructural projects.

Size-wise demand of rebar

Source: NewVision Reseach

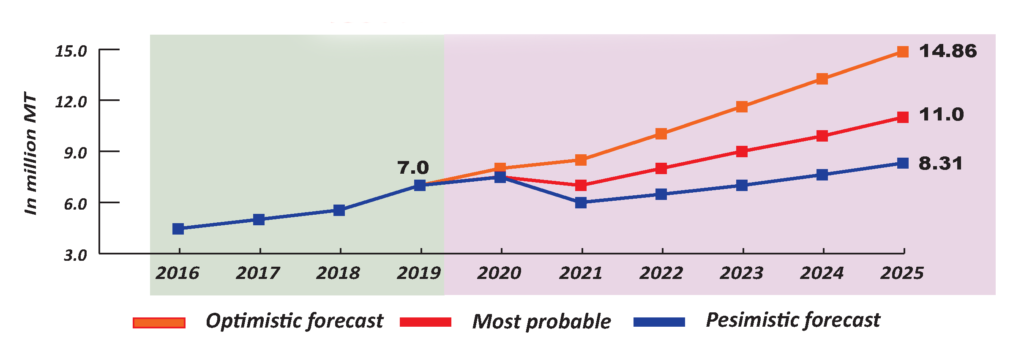

There is considerable uncertainty in the projections of future demand due to ongoing coronavirus crisis. The impact of recent events will reflect on future demand and the industry may not achieve 10% to 15% growth as previously expected.

The actual demand may be lower than the most probable estimate in case there is a prolonged lockdown of factories and postponement of government’s infrastructure projects due to shortage of funds while the country fights the coronavirus.

Under the best-case scenario, the current stagnant period may well be over by the end of 2020 and a boost in demand from 2021 onward would bring the steel industry back to the pre-corona situation.

Current demand and forecast of rebar

Source: NewVision Reseach

Steel usage in the construction sector

Despite the coronavirus outbreak, Bangladesh steel industry has a huge potential given the implementation of mega infrastructure projects such as Padma Bridge, Metro Rail, Rooppur Nuclear Power Plant and construction of a number of economic zones. Private sector and household users will also consume a significant quantity of steel once this global pandemic is over.

Currently, port facility in Bangladesh is inadequate and for that scrap carrying big vessels cannot enter into the Chittagong and Mongla port. However, the government has plans to develop existing ports while building new ports – proposed Mirershoriai Ocean Front Economic Zone and Payra port for instance. Once these proposed ports are built, steel manufacturers will be able to bring scrap easily which would enable them to produce products faster than now.

On the contrary, local steelmakers largely depend on international market for their raw materials needs and these companies are now exposed to shocking disruption in global trade due to COVID-19 crisis. If there is a shortage or price hike of raw materials then production cost will increase which could affect profit margin that is already soured.

At present, there is no Anti-Dumping Tariffs for the steel industry in Bangladesh. However, local manufacturers are protected by high import tariffs policy. Some of the local steelmakers have a good connection with the government and they often influence relevant officials to impose high tariffs on finished products so that imported products remain expensive.

Uncertain future ahead

Steel industry is heavily dependent on the construction sector and this sector is set to face serious challenge due to disruption in economic and development activities which are mostly put on hold at the moment. Construction activities and implementation of infrastructure projects have already halved due to shortage of labour.

The construction sector is very labour incentive and under the current situation, workers are fearful to return to work as they operate in an environment where social distancing is very difficult.

The government has announced various stimulus packages to boost the economic activities and steelmakers of Bangladesh should also be entitled to receive such support. Most of the companies are facing extreme shortages of working capital to pay salary to their staff due to a slump in sales.

If the pandemic is not brought under control, and the government fails to coordinate policy responses, the decline could be even more. Two factors will determine the strength of the recovery. One, how quickly the pandemic is brought under control. And two, the policy choices the government of Bangladesh make to rescue its promising steel industry.

GLOBAL CORONAVIRUS STATS

Author: Sujon Ahamed, Business Consultant (sahamed@newvision.rosetech.dev), NewVision Solutions Ltd.

Uncertain future ahead

1. Ceramic and steel manufacturers not far behind(2020, May 03). Retrieved from https://www.thedailystar.net/business/news/ceramic-and-steel-manufacturers-not-far-behind-1895458

2. Construction sector staring at an uncertain future due to coronavirus pandemic (2020, May 02). Retrieved from https://www.thedailystar.net/star-infrastructure/news/construction-sector-staring-uncertain-future-due-coronavirus-pandemic-188737