Key Highlights

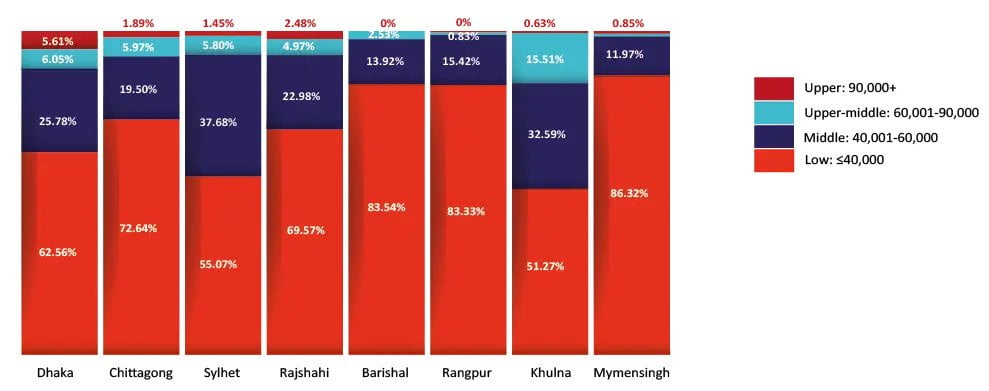

Our survey findings suggest that majority of the people across all eight divisions of Bangladesh earn less than BDT 40,000 (472 USD) in a month. The number of middle-income groups, on the other hand, is rising not only in Dhaka but also in Sylhet, Khulna, and Mymensingh – an indication that prosperity is spreading due to regionalised economic activities.

Most of the households having a low income (less than BDT 40,000 per month) predominantly live in the rural areas followed by sub-urban areas. Despite experiencing substantial economic growth in the urban areas – mainly City Corporation and divisional areas – a large number of marginalised people are still just getting by with their life.

When it comes to expenditure, consumers regardless of their monthly income spend significant portions of their income on food followed by education, medical care, electricity and transport – households having monthly income of more than BDT 90,000 (USD 1,062) spend more than BDT 20,000 per month on the above mentioned items.

Bangladeshi consumers usually prefer to save money for the future and our study indicates that households in Dhaka division on an average save BDT 7,000 per month followed by Sylhet area where the amount is just above BDT 5,000. Consumers of the upper end tend to save around BDT 14,000 per month confirming that the savings rise as income rises.

The rise of consumerism in Bangladesh: a new consumer market

Henry Kissinger, an elder statesman who served as an influential US Secretary of State in the 1970s derisively referred to Bangladesh as a “basket case” in December 1971 at a time when its people were suffering from one of the world’s worst atrocities in human history.

After almost only half a century of its independence, rising from the ashes of great tragedy, widespread poverty, unstable governance, politics and poor infrastructure, Bangladesh has become a ‘basket of hope’. Even though to the rest of the world, Bangladesh remains a poor agrarian country, it has performed spectacularly in the recent past to deserve more than just a ‘poor country’. Bangladesh’s Gross Domestic Product (GDP) has been growing at over 6% annually for the last 7 years and has achieved 8.13% growth in the last fiscal year, 2018-19.

Its income per head grew drastically from less than USD 500 in 1990 to USD 1,910 in 2019. This rise in incomes is most apparent in Dhaka city, the capital of Bangladesh, home to mega-shopping complexes like Jamuna Future Park and Bashundhara Shopping Mall which are jam-packed with throngs of people.

Convenience shops like Swapno and Meena Bazar are opening new branches around every corner of the city areas. While foreign brand outlets such as Miniso, Inglot and, Crimson Cup Coffee have already penetrated in the country. Rapidly expanding food market is giving way to domestically-owned restaurants like Mad Chef and foreign-owned food giants like Burger King, Domino’s Pizza and Japanese restaurants like Izumi, Ginza and Kiyoshi – only to name a few.

While Bangladesh has already graduated from being ‘low income’ to ‘lower-middle-income’ in 2015, it is also poised to graduate from the category of ‘Least Developed Country’ (LDC)

in 2024 being the first country to meet all three graduation thresholds of the LDC criteria.

It can be correctly inferred by the trajectory of Bangladesh’s economy that disposable incomes of its people will increase leading to rising levels of consumption – for both locally produced and imported products.

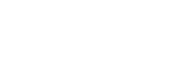

To examine the characteristics of the consumers and explore the consumer preferences, attitudes and spending patterns of the consumers in the country of miraculous growth, NewVision Solutions Ltd. surveyed 2,139 households from 44 districts of Bangladesh during March and April of 2019.

Table of Content

- 1.3 Monthly household income by area

- 1.4 Monthly expenditure by income

- 1.5 Monthly expenditure by division

- 1.6 Monthly expenditure by gender of household head

- 1.7 Monthly savings by income

- 1.8 Monthly savings by division

- 1.9 Monthly savings by gender of household head

- 2.4 Smartphone use by income

- 2.5 Usage of mobile phone

- 2.6 Preferred medium for payments and social media

- 3.3 Confidence in sales schemes

- 3.4 Preferred sales schemes

- 3.5 Preferred place of shopping

- 3.6 Peferred country of origin for products

- 4.2 Belief about happiness in life

Chapter 1 : Income, Expenditure & Savings

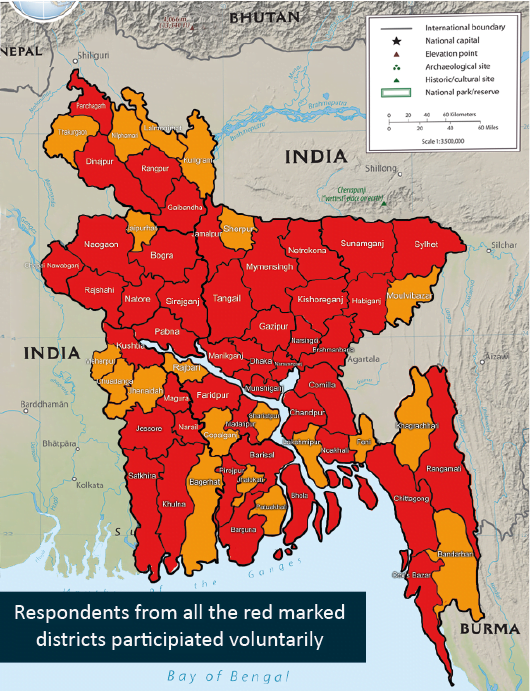

1.1 Monthly individual earning by division

To help in comparison and analyses, we segmented the respondents into five income groups: nil, people with no income; low, consisting of people with monthly income under BDT 20,000; middle, comprising of people earning between BDT 20,000 and BDT 40,000;

Figure 1: Individual earning by division

Q. What is the name of your division?

Q. Your monthly individual earning?

upper-middle, referring to those with income between BDT 40,000 and BDT 60,000 and upper, earning more than BDT 60,000. It can be seen that in all of the divisions, the majority of people earn below 40,000 BDT in a month.

It is not surprising that almost half of the respondents in Barishal reported having no individual income as this area has the highest poverty rate among the other eight divisions (Bangladesh Poverty Maps 2010).

It may be puzzling to some that 41 percent of the respondents in Dhaka – the economic powerhouse of Bangladesh which contributes 36 percent of the total GDP – have no income. This group of people either lives with their parents or currently searching for jobs after completing some form of education.

As a matter of fact, Dhaka division accommodates 32.3 percent of the country’s poor population, the highest share in

Bangladesh, due to mass migration towards Dhaka from other poorer divisions.

Overall, an overwhelming majority of people belong to low- and middle-income groups. It can be expected that the middle-income group will attain or have already attained the power to purchase a wide variety of consumer and leisure goods and services.

In Sylhet, Khulna and Mymensingh, half of the people reported to being in the middle-income group indicating that there is considerable prosperity in non-Dhaka areas calling for regionalised economic activity away from Dhaka.

1.2 Monthly household income by division

According to our research, the average household size in Bangladesh is 5 members, which is corroborated by United Nations’ 2014 report. Due to strong family-orientation, household income plays a big role in the consumption behaviour of local people. Figure 2 exhibits the division -wise monthly household income which may provide further insights.

Similar to the individual incomes, we segmented the households into four income groups: low, consisting of households with monthly income under BDT 40,000; middle, comprising of households earning between BDT 40,000 and BDT 60,000;

Figure 2: Household earning by division

Q. What is the name of your division?

Q. Your monthly household earnings?

upper-middle, referring to those with income between BDT 60,000 and BDT 90,000 and upper, earning more than BDT 90,000. It can be seen that majority of the people earn below 40,000 BDT in a month across all divisions.

The diagram clearly shows that more than 50 percent of surveyed households reported having incomes less than BDT 40,000 per month in all divisions and a smaller percentage of households earn more than BDT 40,000. As per expectations, 6 percent households in Dhaka have more than BDT 90,000 as income, the highest among all divisions.

Chapter 2 : Use of Internet, Mobile Phones & Electronic Commerce

2.1 Proportion of internet access

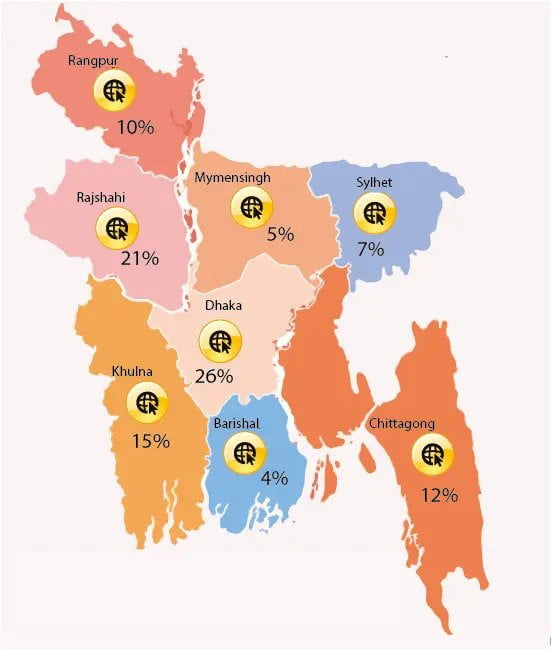

The rapidly growing consumers of Bangladesh are increasingly relying on the internet for daily activities rather than traditional methods. As a start, we can look at the proportion of households who have access to the internet.

The figure below shows that 1,326 respondents reported having access to the internet – the majority of the households are located in Dhaka division at 26 percent whereas Barishal and Mymensingh have the lowest proportion.

Chapter 1 : Income, Expenditure & Savings

Q. What is the name of your division?

Q. Do you have Internet access in the household ?

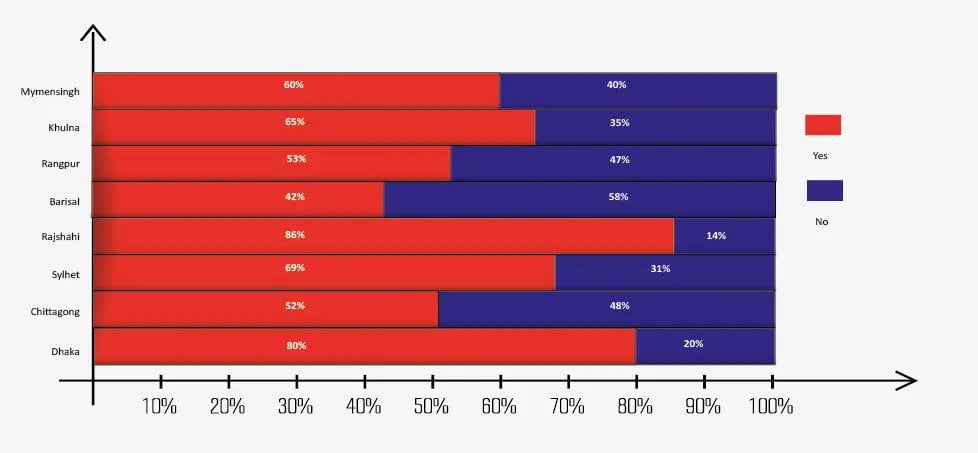

2.2 Internet access by division

Figure 11 shows that except for Barishal, across all other divisions, the rate of internet penetration is more than 50 percent, For example, in Dhaka division out of 440 respondents, 351 (80%) respondents said that they have internet access in their household. Similarly, in other divisions this rate is more than 50%.

Figure 11: Internet access by division.

Q. What is the name of your division?

Q. Do you have Internet access in the household?

This might seem low even though the present government has undertaken initiatives to transform the country into “Digital Bangladesh”. Two points to bear in mind, firstly, even though many may not have internet access in their households but they may still use internet connection of other households. Thus, access does not fully capture usage.

Secondly, internet users have increased immensely from 30 million in 2012 to 93 million in April 2019, according to the Bangladesh Telecommunication Regulatory Commission (BTRC).

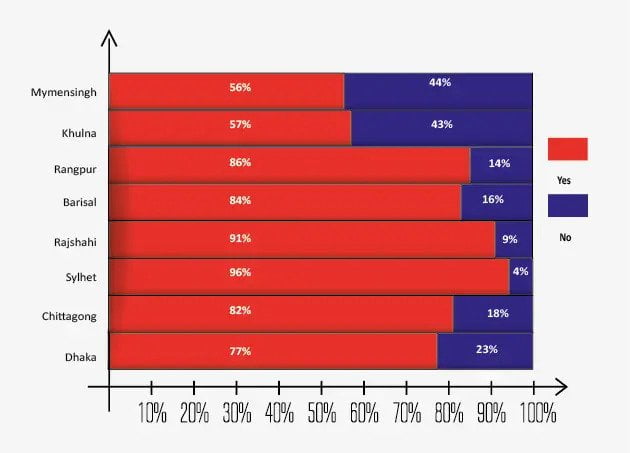

2.3 Smartphone usage

Furthermore, figure 12 shows that among the surveyed consumers, more than half already use smartphones with the highest percentage in Sylhet of about 95 percent.

Figure 12: Current smartphone access.

Q. What is the name of your division?

Q. Do you use a smartphone?

Chapter 3 : Purchasing Patterns & Preferences

Furthermore, figure 12 shows that among the surveyed consumers, more than half already use smartphones with the highest percentage in Sylhet of about 95 percent.

3.1 Factors that affect the purchasing decision

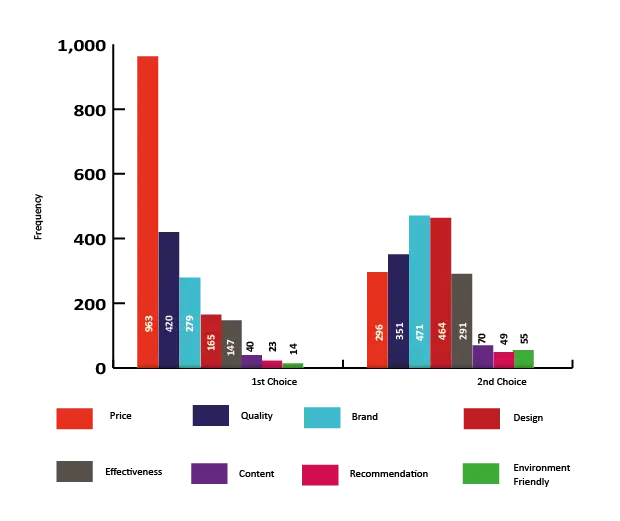

About 47 percent of the respondents indicated that price is the major determinant of their purchases as depicted in Figure 18.

This implies that Bangladeshi consumers are more likely to buy low-cost items than branded or quality items.

Additionally, they give the least importance to environment-friendly products. Once the price point is managed, the second most important feature is the brand. Thus, consumers are willing to buy branded items only if the price is favorable.

Figure 18: Features for purchase

Q. Which type of payment you prefer the most?

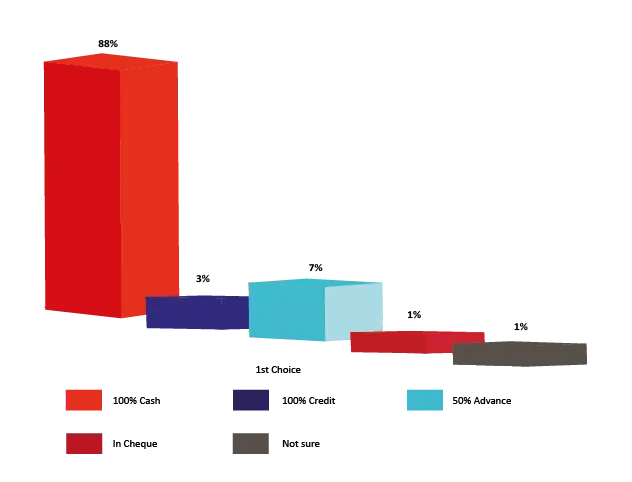

This trend is consistent when preference is disaggregated by area as seen in Figure 20. In all three areas, cash is the most preferred option of paying.

This points out that companies interested in the burgeoning consumer market of Bangladesh should endorse cash payment methods such as cash on delivery until digitalized payment systems are widespread.

3.2 Preferred form of payment

Additionally, they give the least importance to environment-friendly products. Once the price point is managed, the second most important feature is the brand. Thus, consumers are willing to buy branded items only if the price is favorable.

Since the number of people employed in the informal sectors is an overwhelming 87.5 percent of the total labour force (Labour Force Survey 2010) and majority of them do not have a bank account which could explain why cash payment is the most preferred choice.

3.2 Preferred form of payment

Q. Which type of payment you prefer the most?

Chapter 4: Perception about well-being & future

4.1 Belief about happiness in life

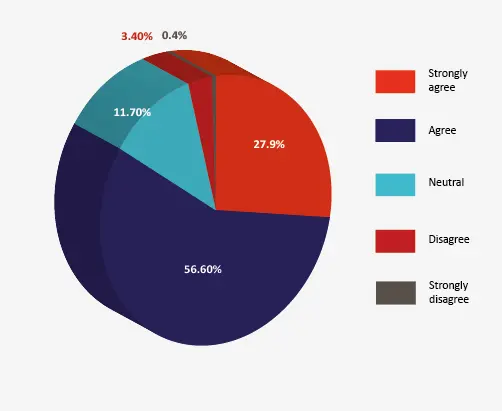

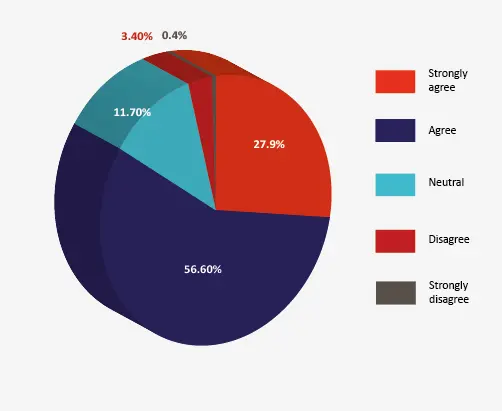

To get a picture of the attitudes and well-being of Bangladeshi consumers, we also asked the respondents whether they are happy in life and whether they believe that there is an improvement in their lives as time passes. Our findings show that more than 84% of the surveyed Bangladeshi consumers consider themselves content or happy with their current life (Figure 28). Majority of urban, semi-urban and rural respondents agree that they are happy with their current life and that they will have a better life in the next two years (Figure 29).

Figure 28: Happiness in life

Q. Do you consider yourself content/happy with your life right now?

Figure 29: Happiness by area

Q. Do you consider your happiness by the area you live in?

We thank the following people for their contribution to the report:

- Sujon Ahamed

- Editor and co-author

- sahamed@newvision.rosetech.dev

- Abdul Wadud Shuvo

- Edit and design

- awadud@newvision.rosetech.dev

- Sarah Enamul Haque

- Co-author

- sarahenamulhaque@hotmail.com

- MD Kawser Ahmed

- Edit and design

- kahamed@newvision.rosetech.dev

- Md Atiqul Islam

- Data analysis

- aislam@newvision.rosetech.dev

- MD Obaid Hossain

- Edit and design

- obaidhossain.me@gmail.com

- Md Atiqul Islam

- Data analysis

- aislam@newvision.rosetech.dev