Overview of the Bangladesh Cement Industry

A global pandemic caused by COVID-19 has hit almost every manufacturing sector in the world. Bangladesh’s manufacturing and industrial sectors are no exception to that. A total of 52-day lockdown has been announced by the government from 26th March till 16th May 2020. Bangladesh cement industry – a key construction material – is vastly affected by the lockdown caused by the coronavirus pandemic.

All the manufacturing plants of the cement industry are being shut down to maintain social distancing. Consumption rate is also next to zero as almost all of the mega projects are currently in standstill situation including the real estate sector.

With the continuous development of the country, the cement industry has been playing a significant role in infrastructure development. The consumption of cement has increased significantly over the past several years in the country due to rapid urbanization, real estate development, and government projects.

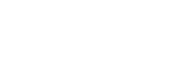

According to the Bangladesh Cement Manufacturers Association (BCMA), the sales of cement reached a high of 33 million tons in 2018, which was 12 per cent more than the previous year. But about 15 years ago Bangladesh manufactured only ordinary cement using around 95 % clinker.

During 2018, the per capita consumption of cement was around 1871kg, whereas the world average consumption is more than 500 kg. Currently, there are 37 companies manufacturing cement and some of which even export

Due to increasing demand in the domestic market, most of the companies have expanded their production capacity. As a result, the combined yearly production capacity of the Bangladesh cement industry currently stands at 68 million tonnes. More than double the country’s actual demand.

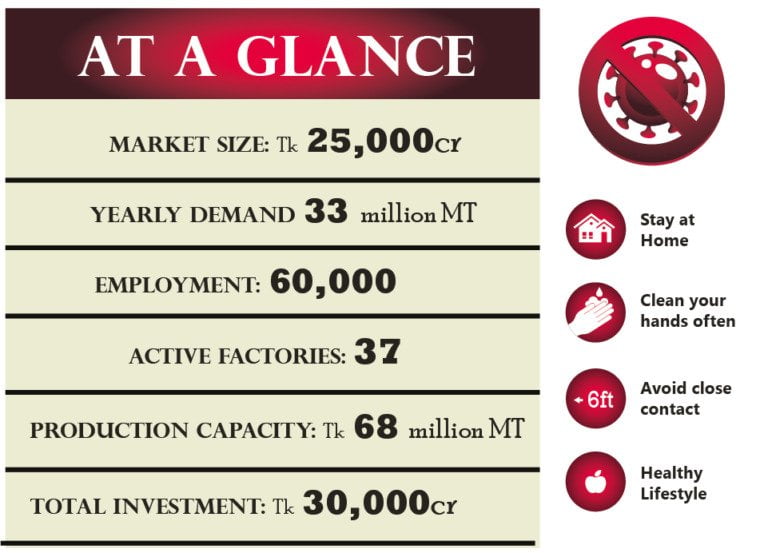

Global cement production

In 2019, the worldwide total volume of cement production was 4.2 billion metric tons. Of the total production, China produced more than 50% or 2,200 million metric tons. India, the 2nd largest cement producer of the world manufactured 320 million metric tons during the same period.

Major countries in worldwide cement production from 2015 to 2019

Source: Estern Bank Securities Ltd

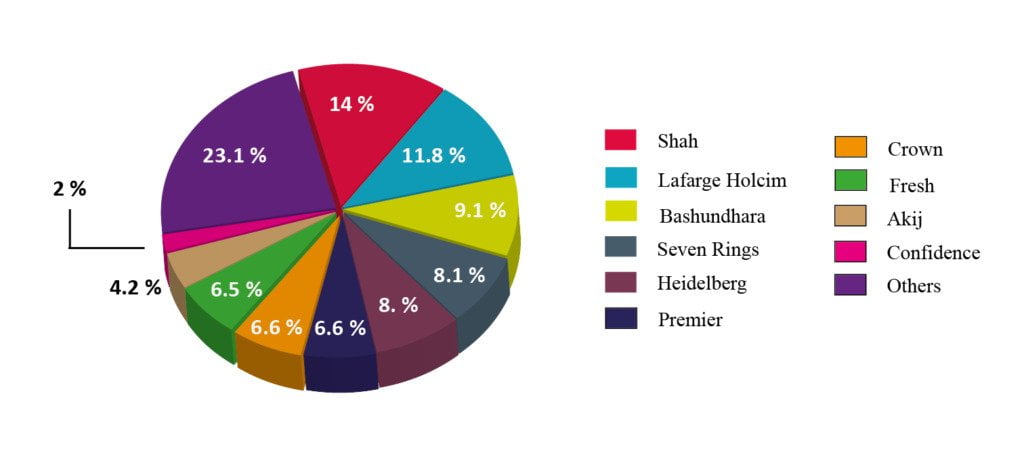

Domestic market share

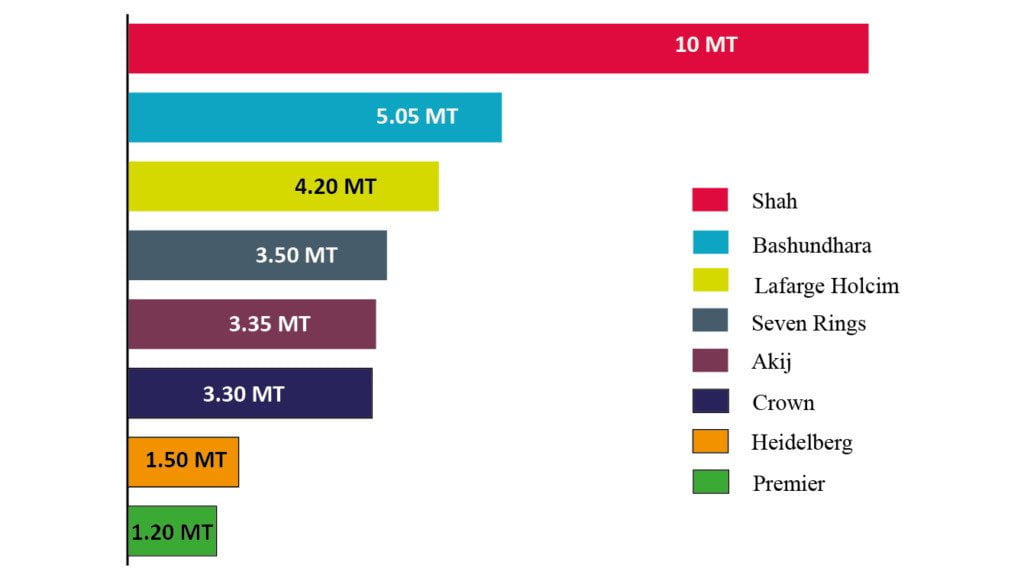

Despite having the presence of multinational companies, local manufacturers dominate the domestic market. Shah Cement, a concern of Abul Khair Group, is the market leader which has the country’s largest cement producing plant. The company has a production capacity of 10 million metric tons per year. Its plant is thought to be one of the most technologically advanced in the whole country. The company has already installed the world’s largest Vertical Mill to offer premium quality cement products to growing domestic customers.

Major brands and their market share

LafargeHolcim Bangladesh, which was established through a joint venture between LafargeHolcim and Cemontos Molins. This company is also a major player who produces world-class cement. The company also prides itself as a producer of clinker, only a few company has such capability. It sources limestone, the basic raw materials, from its quarry in Meghalaya, India. By producing clinker locally, LafargeHolcim has reduced dependency on imports thereby saving US$ 45 million in foreign exchanges each year.

Top manufacturers according to production capacity (In million metric tons)

Source: Respective companies’ website

Due to ongoing development of infrastructure and housing projects, the cement industry has seen a surge in demand. Per capita consumption of cement in Bangladesh still remains relatively low. Currently, 181kg which is expected to be 220kg by 2020.

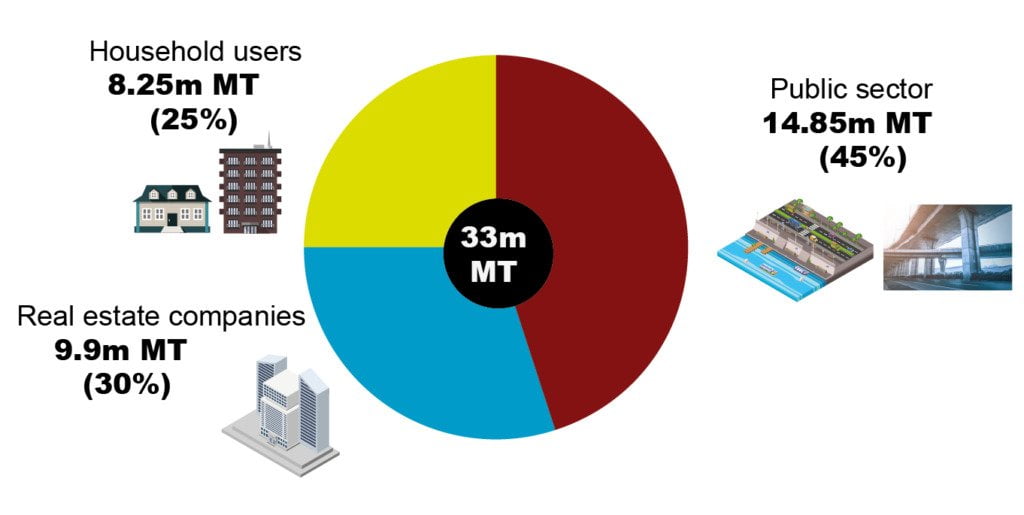

The public sector is the main buyer using almost half of the 33 million tons of cement sold per annum. A driving force behind the 12-15% year-on-year growth for the cement industry.

Many mega projects are launched and currently being implemented in Bangladesh. Padma Bridge, Padma Rail Link, Metro Rail, Matabari Coal Power Plant, Chattrogram-Cox’s Bazar Rail Line, Rampal Power Plant, Payra Deep Sea Port, and Rooppur Nuclear Power Plant are some of the large projects . All these projects require a large amount of cement along with other construction materials. This will essentially increase the demand despite the temporary stoppage of all economic activities due to coronavirus pandemic.

End users of cement

Source: NewVision research

Cement manufacturers of Bangladesh highly depend on imported raw materials and import majority portion of oil, clinker, limestone, and gypsum for their cement production. Among the imported materials, clinker is mostly used in the process of cement production.

Only two companies – Chhatak Cement Factory Ltd, a government-owned company, and Lafarge Surma Cement Ltd – out of 37 active cement manufacturers have the facility to produce clinker. These two companies only produce 20 per cent of the total required clinker and the rest are imported mainly from China, Russia, Thailand, Vietnam, and Malaysia.

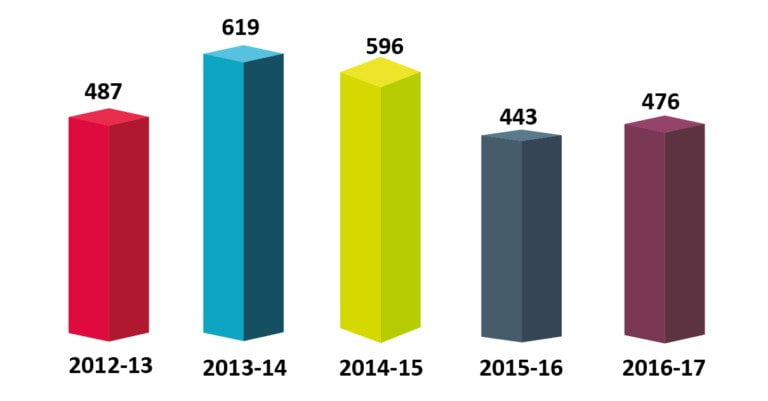

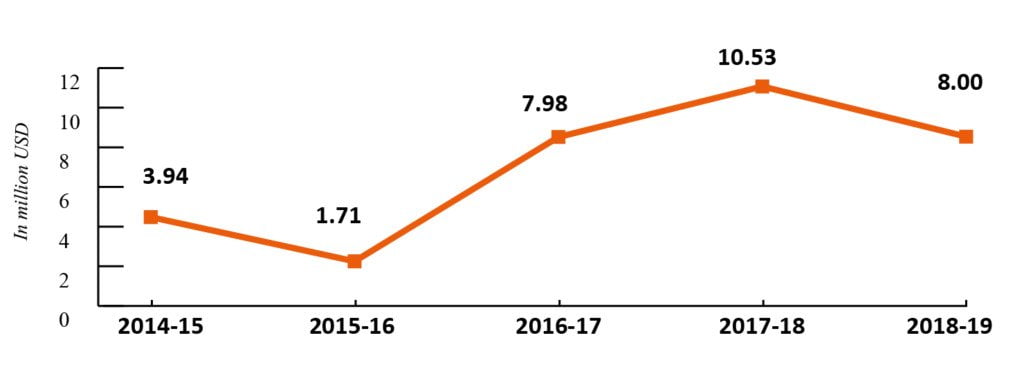

Year-wise import of clinker (value in million USD)

Source: Bangladesh Bank

After meeting up the local demand, cement manufacturers of Bangladesh export portland cement to India, Saint Barthelme, and Myanmar. The state-owned Chhatak Cement Factory exported cement in the early 2000s for the first time.

At present, 14 companies are exporting their cement abroad. Of those Crown Cement is the leading exporter in the country while Shah Cement, Bashundhara Cement, Fresh Cement, Metrocem Cement, and Premier Cement have also penetrated markets beyond the national border.

Year-wise export of cement (value in million USD)

What is the current situation of the Bangladesh cement industry?

In case of a prolonged lockdown, the cement industry will suffer a lot as during the event of an economic crisis, individuals and corporates tend to direct their expenses toward essential items –cement as a construction material will certainly not fall into that category.

On the contrary, the government would accelerate expending in infrastructure projects in a bid to offset major setback on its economy. That should give cement manufacturers a breathing space as they are likely to expect an increase in demand once the government eases the lockdown. Another good news for the industry is that the price of key raw materials has already fallen to 10-15 per cent in the international market due to coronavirus outbreak.

To overcome the current crisis what the cement industry now need is the working capital which has hit hard due to low revenue from sales and slow collection of receivables. In a letter to the government, Bangladesh Cement Manufacturers Association (BCMA) has requested to defer the payment of utility bills for at least six months.

The association has further requested the withdrawal of minimum advanced income tax (AIT) of raw materials which is currently 3 per cent and importers have to pay it up front regardless of whether they are making a profit on not.

The silver lining for the Bangladesh cement industry is that a BDT 30,000 crore working capital loan package for industries and service sector to combat the potential fallout of the COVID-19 crisis. At a subsidized 4.5% interest rate, cement manufacturers are also eligible to avail this loan to pay their workers and other operational activities.

The silver lining for the Bangladesh cement industry is that a BDT 30,000 crore working capital loan package for industries and service sector to combat the potential fallout of the COVID-19 crisis. At a subsidized 4.5% interest rate, cement manufacturers are also eligible to avail this loan to pay their workers and other operational activities.

Reporting by MD Nasir Uddin (nuddin@newvision.rosetech.dev), Editing and Designed by Sujon Ahamed, Business Consultant (sahamed@newvision.rosetech.dev), NewVision Solutions Ltd.

What is the current situation of the Bangladesh cement industry?

1. Ceramic and steel manufacturers not far behind(2020, May 03). Retrieved from https://www.thedailystar.net/business/news/ceramic-and-steel-manufacturers-not-far-behind-1895458

2. Construction sector staring at an uncertain future due to coronavirus pandemic (2020, May 02). Retrieved from https://www.thedailystar.net/star-infrastructure/news/construction-sector-staring-uncertain-future-due-coronavirus-pandemic-1887373