How Government of Bangladesh is Tackling Coronavirus with Financial Assistance Packages

N

Date published : 22nd April 2020

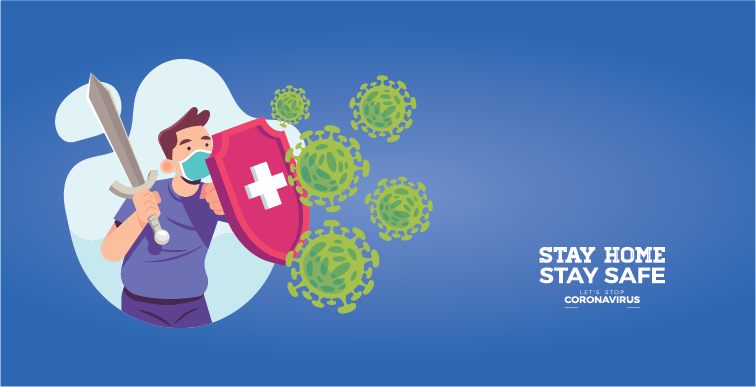

Sequence of Global COVID-19 Events

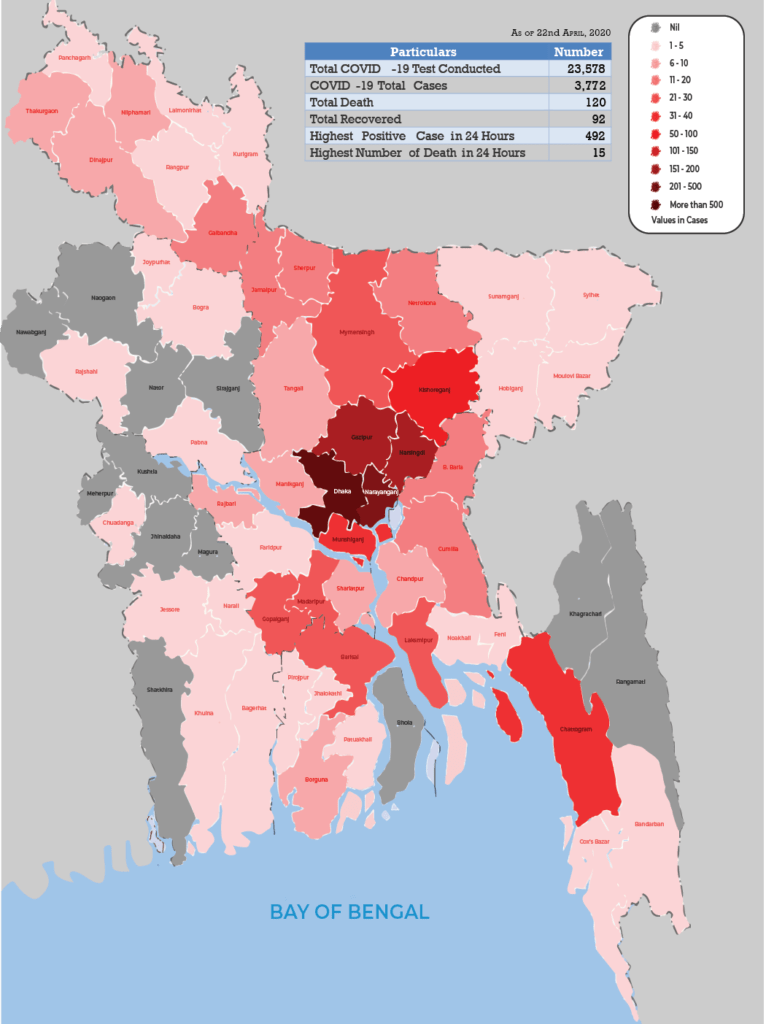

Corona Situation in Bangladesh:

Measures and Initiatives taken by the Government of Bangladesh:

Fiscal Measures to Mitigate Economic Downturn Due to Coronavirus Impact:

Package-1

Volume: BDT 5,000 Crore

Targeted Sector: Ready Made Garments (RMG)

Package type: Working Capital Loan

Interest rate: 2%

For more information please visit this link: https://www.bb.org.bd/mediaroom/circulars/brpd/apr022020brpd07.pdf

Package-2

Volume: BDT 30,000 Crore

Targeted Sector: Big industries and Service sector

Package type: Working Capital Loan

Interest rate: 4.5%

For more information please visit this link: https://www.bb.org.bd/mediaroom/circulars/brpd/apr122020brpd8.pdf

Package-3

Volume: BDT 20,000 Crore

Targeted Sector: Cottage, micro, small and medium enterprises (CMSME)

Package type: Working Capital Loan

Interest rate: 4%

For more information please visit this link: https://www.bb.org.bd/mediaroom/circulars/smespd/apr132020smespd01.pdf

Package-4

Volume: BDT 12,750 Crore

Targeted Sector: Export Oriented Industry.

Package type: Export Development Fund

Interest rate: 2%

Package-5

Volume: BDT 5,000 Crore

Targeted Sector: Export Oriented Industry.

Package type: Pre-shipment credit

Interest rate: Up to 6%

For more information please visit this link: https://www.bb.org.bd/mediaroom/circulars/brpd/apr132020brpd09.pdf

Package-6

Volume: BDT 5,000 Crore

Targeted Sector: Agriculture.

Package type: Loan- Small and Medium Farmers, Poultry and Dairy sector.

Interest rate: 4%

For more information please visit this link: https://www.bb.org.bd/mediaroom/circulars/brpd/apr132020brpd09.pdf

Other Major Incentive and Subsidy Packages

Source: Prime Ministers ‘ Speech

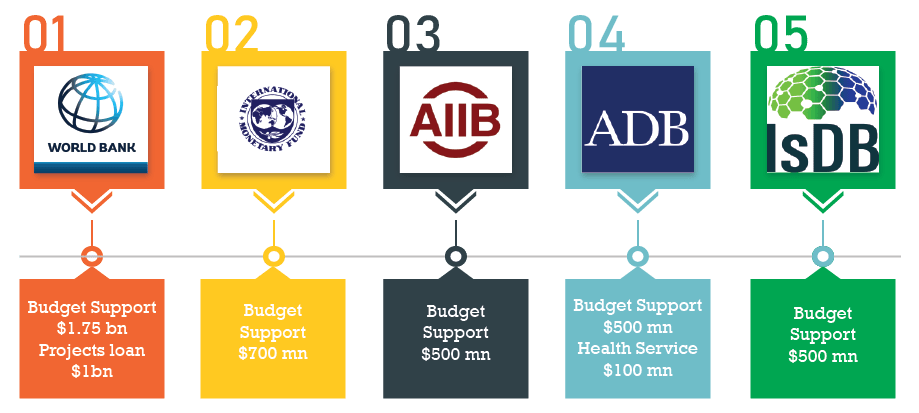

Government of Bangladesh Seek Budget Support:

Source: Finance Ministry, Bangladesh

Concluding Remarks:

Author: Md. Atiqul Islam, Sr. Research Associate (Email: aislam@newvision.rosetech.dev )

Editor: Sujon Ahamed, Head of Market Research (Email: sahamed@newvision.rosetech.dev )

Designed by: Md. Atiqul Islam and Md Obaid Hossain (Research Assistant)

Coronavirus Statistics for Bangladesh: